Introduction

Navigating the world of credit can feel like a daunting task, especially when it comes to understanding complex systems like China’s Social Credit System. This unique framework not only impacts how individuals and businesses are assessed but also raises questions about the nature of credit reporting on an international scale. As we delve into this topic, we’ll clarify what China’s system entails, its implications for various stakeholders, and debunk some common myths surrounding credit reports.

Understanding China's Social Credit System

At its core, China's Social Credit System is designed to evaluate citizens' and businesses' trustworthiness based on their behavior and transactions. This evaluation process has sparked global interest, particularly regarding whether China has credit reports similar to those in Western countries. By examining how the system operates, we can better understand its far-reaching effects on both personal and business finances within China.

How It Affects Individuals and Businesses

The ramifications of the Social Credit System extend well beyond individual citizens; they significantly impact businesses as well. For instance, companies with high social credit scores may enjoy benefits such as easier access to loans or favorable terms with suppliers. Conversely, negative scores could hinder a business's ability to operate effectively within both domestic and international markets—an important consideration for anyone looking into China Business Credit Reports.

Debunking Myths Around Credit Reports

Despite the increasing attention on China's Social Credit System, many misconceptions persist about how it compares with traditional credit reporting practices globally. One common question is: Are credit reports international? The answer is nuanced; while some aspects are universal, others vary greatly by region—especially when considering how to get a credit report in China versus elsewhere. By addressing these myths directly, we aim to provide clarity around what individuals need to know about their own financial standing in this evolving landscape.

Overview of China’s Social Credit System

China's Social Credit System is a multifaceted mechanism designed to assess the trustworthiness of individuals and businesses based on their behaviors and interactions. Its primary purpose is to enhance societal trust, promote good behavior, and discourage misconduct by providing a quantifiable score that reflects one’s reliability. As the system evolves, it raises questions about its implications for international credit reports and how they intersect with China's unique approach to credit scoring.

Definition and Purpose of the System

At its core, the Social Credit System aims to create a culture of trustworthiness among citizens and enterprises in China. By evaluating various aspects of social behavior—such as financial responsibility, legal compliance, and even social interactions—the system generates scores that can influence access to services or opportunities. This has led many to wonder: Does China have credit reports? The answer is yes, but they are integrated into a broader social monitoring framework rather than existing as standalone documents.

Historical Context and Evolution

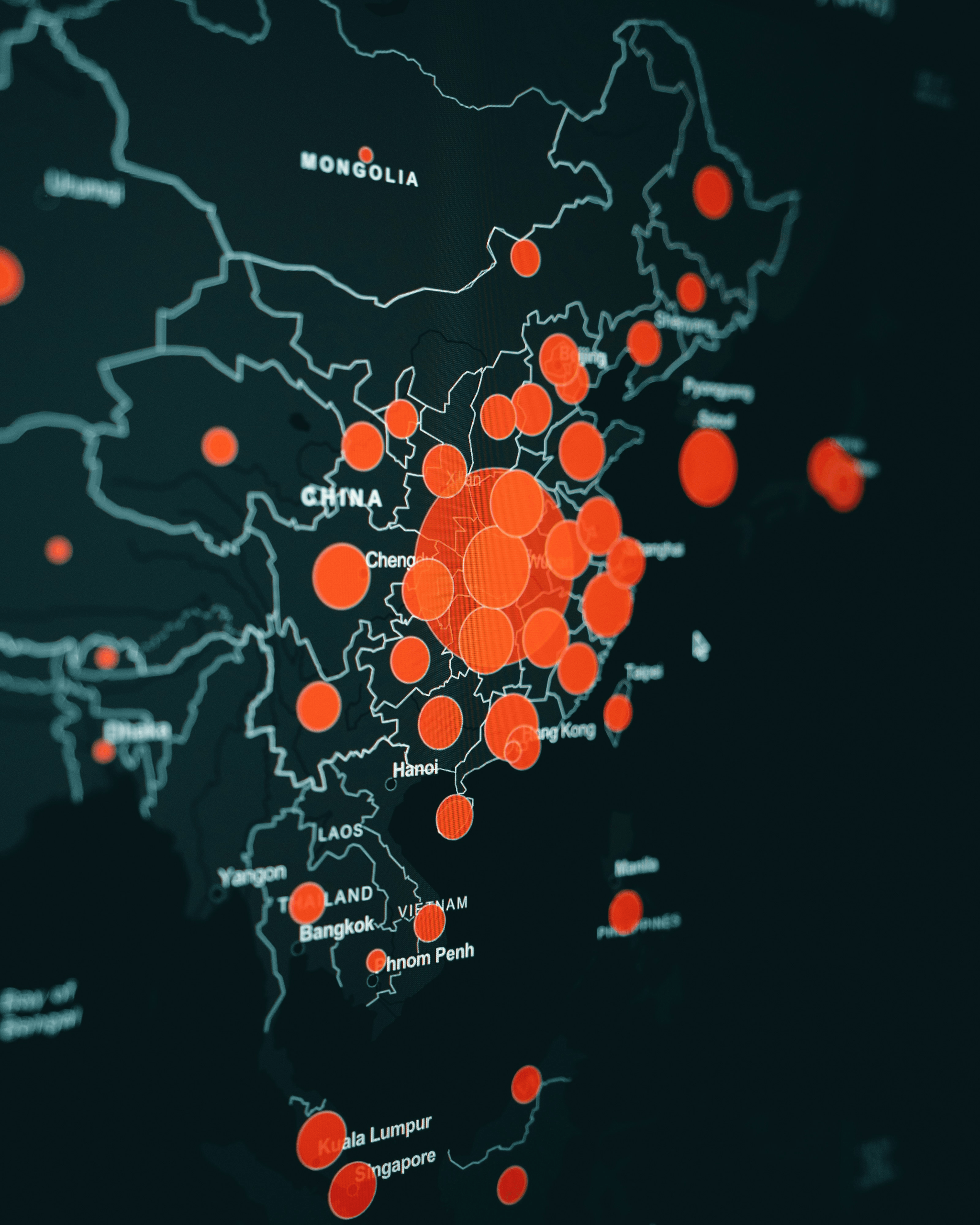

The roots of China's Social Credit System can be traced back to early 2000s initiatives aimed at improving financial transparency and accountability. Over the years, it has evolved significantly from pilot programs in select cities to a nationwide initiative encompassing diverse data sources—from financial transactions to online activities. This historical evolution raises important questions about international credit reports; specifically, how does this system align with global standards in credit reporting?

Key Players Involved in the Implementation

The implementation of China's Social Credit System involves various stakeholders ranging from government agencies to private tech companies. Key players include local governments responsible for collecting data, state-owned enterprises that enforce regulations, and private firms that develop scoring algorithms. Understanding these players is crucial when considering how to get a credit report in China or navigate the complexities surrounding China Business Credit Reports within an international context.

How Does China’s Social Credit System Work?

China's Social Credit System is a complex web of scoring mechanisms that assess individuals and businesses based on their behavior and trustworthiness. This system uses various metrics to generate scores, which can influence everything from loan approvals to travel privileges. Understanding how these scoring mechanisms operate is crucial for anyone navigating the landscape of credit in China.

Scoring Mechanisms Explained

The scoring mechanisms in China's Social Credit System are multifaceted, often drawing comparisons to traditional international credit reports but with a twist. Scores can range widely, affecting not just financial transactions but also social interactions and opportunities. For businesses, a high score can lead to benefits like easier access to loans or government contracts, while a low score might result in restrictions or penalties.

In contrast to conventional credit scores that primarily consider financial history, China's system incorporates diverse factors such as compliance with laws, social behavior, and even public opinions. The integration of these elements makes it essential for individuals and companies alike to maintain a positive standing within this unique framework. Therefore, understanding how these scores are calculated can empower people to take actionable steps toward improving their ratings.

Data Sources and Collection Methods

Data sources for the Social Credit System are extensive and varied, encompassing everything from financial records to social media activity. The Chinese government collaborates with numerous agencies and private companies to gather information about citizens’ behavior—both online and offline. This data collection process raises questions about privacy but is deemed necessary for maintaining societal order.

Does China have credit reports? Yes, but they differ significantly from what many may expect from international practices; they integrate various behavioral metrics alongside traditional financial data. Additionally, businesses seeking insights into potential partners or clients often turn to specialized China Business Credit Reports that summarize an entity's trustworthiness based on collected data points.

Impact of Social Behavior on Scores

Social behavior plays a pivotal role in determining one's score within the Social Credit System; actions like volunteering or engaging in community service can enhance an individual's rating significantly. Conversely, negative behaviors—such as traffic violations or failing to pay debts—can lead to substantial penalties that affect not only personal freedom but also business operations.

For those wondering how to get a credit report in China or how do I get an international credit report?, it's vital first to grasp how behavioral factors intertwine with traditional reporting methods in this unique system. As the world becomes increasingly interconnected, understanding whether are credit reports international? takes on new significance when considering cross-border business dealings influenced by varying standards across countries.

International Credit Reports and China

Navigating the world of credit reports can sometimes feel like trying to find your way through a maze. When it comes to international credit reports, things get even trickier, especially when you consider how different countries handle their systems. In this section, we will explore whether credit reports are truly international, delve into the specifics of China Business Credit Reports, and provide guidance on how to obtain a credit report in China.

Are Credit Reports International?

The question Are credit reports international? is more complex than it appears at first glance. While many countries have their systems for generating credit reports based on local data, there is no universally accepted format or standard that applies globally. This means that if you're trying to understand how your financial behavior in one country affects your standing in another, you might be in for a surprise—especially when considering China's unique approach to credit reporting.

In fact, the differences between national systems can lead to confusion for businesses and individuals alike. For example, while some nations rely heavily on financial history for their scoring mechanisms, China's Social Credit System incorporates social behavior and compliance with laws into its assessments. Thus, understanding whether Does China have credit reports? becomes essential for anyone looking to engage with Chinese businesses or citizens.

China Business Credit Reports Explained

When it comes to China Business Credit Reports, they serve as an essential tool for both domestic and foreign entities looking to assess potential partners or competitors in the market. These reports compile various data points including financial performance, legal compliance records, and even social behaviors that might impact business dealings. The unique blend of traditional financial metrics and social behaviors makes these reports particularly intriguing—and sometimes perplexing—for those used to more conventional Western models.

China's business ecosystem has evolved rapidly over recent years; thus understanding how these business credit reports function is crucial for anyone planning on operating within this vibrant market. They not only reflect a company's financial health but also its reputation within society—a factor that could make or break a partnership in today's interconnected world. So if you're pondering about How do I get an international credit report?—remember that getting insights from Chinese sources will require some additional effort compared to other regions.

How to Get a Credit Report in China

If you've found yourself asking How to get a credit report in China?, fear not; the process isn't as daunting as it may seem! Generally speaking, obtaining a personal or business credit report involves accessing specific online platforms or engaging local agencies specializing in such services. Many of these platforms are user-friendly and offer English-language options for foreigners navigating the Chinese system.

For businesses wanting detailed insights into potential partners or competitors through their China Business Credit Reports, partnering with local firms familiar with the landscape can ease the process significantly. Additionally, staying updated with guidelines from organizations like the International Committee on Credit Reporting can provide useful context about global standards—helping you ensure compliance while making informed decisions based on accurate data from your desired markets.

Benefits and Drawbacks of the System

China's Social Credit System is a double-edged sword, presenting both advantages and challenges for individuals and businesses alike. While it aims to foster trust and accountability, the implications of this system raise significant questions about privacy, fairness, and international standards in credit reporting. Understanding these benefits and drawbacks is crucial for anyone navigating this complex landscape.

Pros for Individuals and Businesses

One of the primary benefits of China's Social Credit System is its potential to enhance trustworthiness among individuals and businesses. By promoting positive behavior—such as timely bill payments or community involvement—individuals can boost their social credit scores, which can lead to perks like lower loan interest rates or easier access to services. For businesses, a good score may translate into increased customer confidence, better partnerships, and even preferential treatment from government entities.

Moreover, the integration of China Business Credit Reports into this system allows companies to assess potential partners more effectively. This can reduce risks associated with fraud or unreliable business practices. In essence, a well-functioning social credit system could contribute significantly to creating a more reliable economic environment in China.

Risks and Concerns Raised by Critics

Despite its intended benefits, critics argue that China's Social Credit System poses serious risks related to privacy invasion and discrimination. The extensive data collection methods raise concerns over how personal information is used—does China have credit reports that are fair? Many fear that individuals might be unfairly penalized due to minor infractions or misunderstandings.

Additionally, there are worries about how social behavior impacts scores; negative ratings could lead to restrictions on travel or access to services without clear justification. This creates an environment where people may feel pressured to conform socially rather than express individuality freely—a troubling prospect in any society striving for progress.

Navigating the System Effectively

For those looking to navigate the complexities of China's Social Credit System effectively, understanding how it intertwines with international credit reports is vital. Knowing how to get a credit report in China can empower individuals and businesses alike; they can monitor their standing within this intricate web of data collection actively.

Furthermore, being aware of the International Committee on Credit Reporting's role helps illuminate global standards that may influence local practices over time—are credit reports international? With proper knowledge at hand—including insights on how do I get an international credit report?—one can make informed decisions that mitigate risks while maximizing opportunities within this evolving framework.

The Role of the International Committee on Credit Reporting

In an increasingly interconnected world, understanding the role of the International Committee on Credit Reporting is essential for navigating credit landscapes. This committee establishes standards that underpin credit reporting practices globally, ensuring a level of consistency and reliability across borders. As businesses and individuals seek clarity in their financial standing, these standards become crucial in determining how international credit reports are generated and interpreted.

Overview of Credit Reporting Standards

Credit reporting standards serve as the backbone for how financial information is collected, processed, and shared among various entities. These standards aim to create a fair and transparent system where individuals can understand their creditworthiness regardless of geographical boundaries. In essence, they help answer questions like Does China have credit reports? by providing a framework that aligns with international practices while accommodating local nuances.

The establishment of these standards not only benefits consumers but also enhances trust among businesses engaging in cross-border transactions. By adhering to these guidelines, countries like China can improve their own systems—such as China Business Credit Reports—making them more compatible with global norms. This compatibility is vital for fostering international trade relations and ensuring that businesses can confidently assess potential partners' financial health.

How the Committee Influences Global Practices

The International Committee on Credit Reporting wields considerable influence over global credit reporting practices through its advocacy for standardized protocols. By promoting best practices, the committee helps ensure that information sharing remains ethical and accurate across different jurisdictions. This influence is particularly significant when considering how international credit reports are perceived by investors looking to enter markets like China.

As countries adopt these practices, they enhance their credibility in the eyes of international stakeholders who may be wondering how to get a credit report in China or whether those reports align with what they expect from other nations’ systems. The committee's efforts pave the way for greater transparency and accountability in financial dealings worldwide, which ultimately benefits everyone involved—from individual consumers to large corporations.

Furthermore, this influence extends beyond mere recommendations; it actively shapes policies that govern data privacy and protection within credit reporting frameworks globally. As more nations engage with these guidelines, we see an increasing emphasis on consumer rights alongside robust reporting mechanisms—a win-win situation for all parties concerned.

Collaboration Between China and International Bodies

China's engagement with the International Committee on Credit Reporting exemplifies a commitment to refining its own systems while aligning with global best practices. Through collaborative efforts, both parties work toward harmonizing China's unique requirements with established international norms concerning credit assessments—especially regarding questions like How do I get an international credit report?

Such collaboration facilitates knowledge exchange between Chinese authorities responsible for issuing China Business Credit Reports and their counterparts abroad who may be well-versed in different regulatory environments. This cross-pollination of ideas helps streamline processes so that individuals seeking information about their financial standing can navigate both local and international landscapes seamlessly.

Moreover, this partnership fosters confidence among foreign investors who might be apprehensive about entering China's market due to questions surrounding its reporting system's reliability or transparency issues raised previously about social credits versus traditional credits—Are credit reports international? Yes! They should be viewed through this collaborative lens where mutual benefit drives progress forward.

Conclusion

The landscape of credit reporting in China is rapidly evolving, shaped by the unique characteristics of its Social Credit System. As we look toward the future, it’s clear that understanding how this system interacts with international standards will be crucial for both individuals and businesses. With globalization on the rise, questions such as Does China have credit reports? and Are credit reports international? will become increasingly relevant.

Future of Credit Reporting in China

As China's Social Credit System matures, the integration of international credit reports into its framework is likely to gain momentum. This means that understanding China Business Credit Reports will be essential for foreign investors and companies operating within its borders. The collaboration between China's domestic systems and the International Committee on Credit Reporting could pave the way for a more standardized approach to credit assessment globally.

Adapting to a Changing Financial Landscape

Navigating this new financial terrain requires an awareness of how to get a credit report in China and what it entails for both personal and business finances. Individuals must adapt to these changes not only by monitoring their scores but also by understanding how their social behaviors can impact their financial standing. Meanwhile, businesses need to stay informed about international practices in credit reporting, ensuring they can effectively manage their operations across borders.

How AC&E Can Assist with Credit Issues

AC&E stands ready to assist those grappling with questions about international credit reports or seeking guidance on obtaining a China Business Credit Report. Whether you’re wondering how do I get an international credit report or need specific advice on navigating China's Social Credit System, AC&E has you covered. Our expertise ensures that you can confidently tackle your credit issues while keeping pace with an ever-changing financial landscape.