Introduction

In today's global economy, understanding China taxation rates is crucial for businesses and investors alike. With recent changes in China tax rates, it's more important than ever to stay informed. That's where AC&E comes in as your expert guide to navigating the complexities of China taxation.

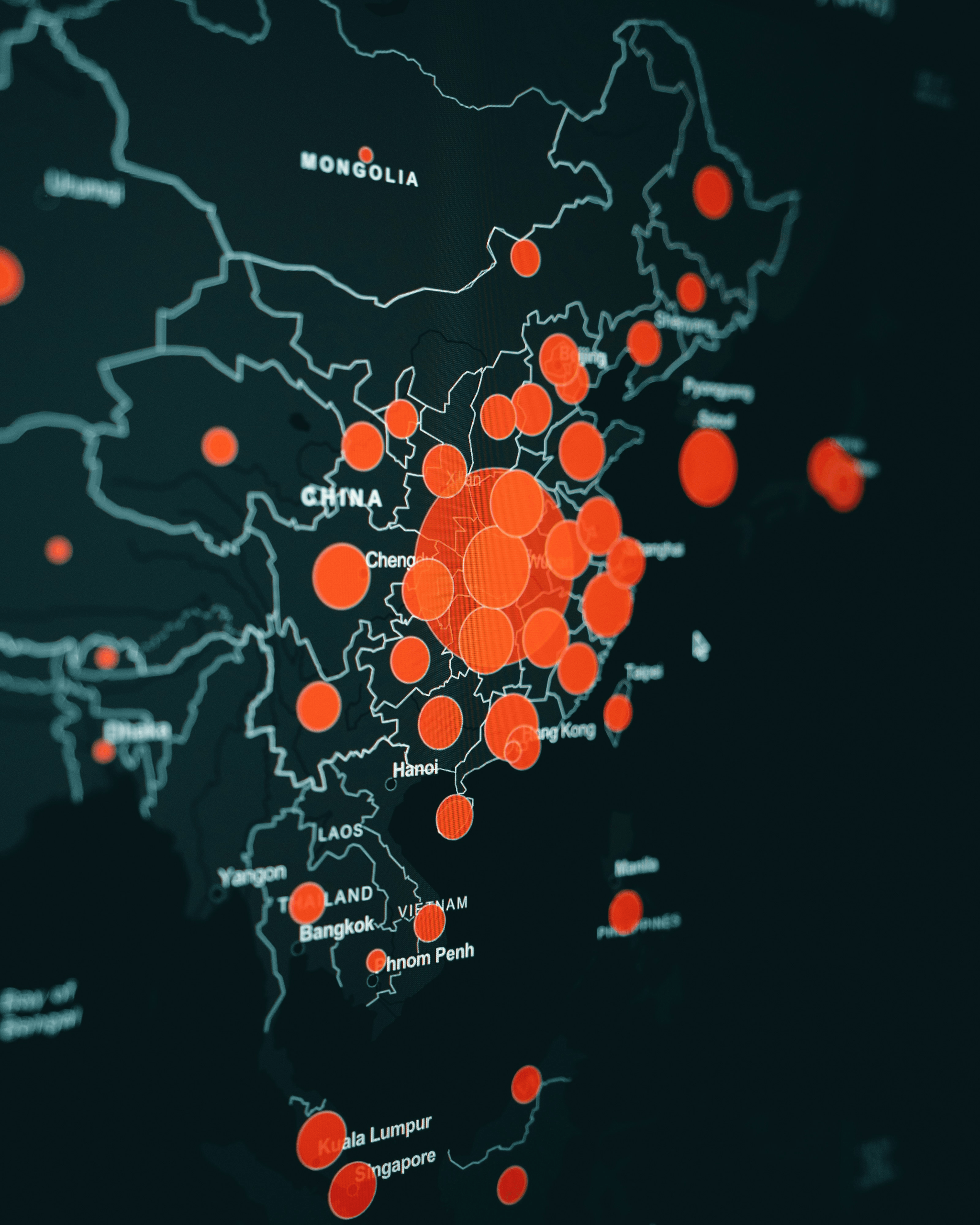

Overview of China Taxation Rates

China taxation rates encompass a wide range of taxes, including corporate tax, individual income tax, value-added tax, and more. These rates can vary based on location and industry, making it essential to have a comprehensive understanding of the tax landscape in China.

Understanding China taxation rates is crucial for businesses and individuals alike, as it directly impacts financial planning and decision-making. With varying tax rates based on location and industry, having a comprehensive understanding of the tax landscape in China is essential for accurate budgeting and forecasting. Moreover, staying informed about tax regulations and changes can help prevent any potential compliance issues or penalties.

Importance of Understanding China Tax Rates

Understanding China tax rates is vital for businesses looking to operate or invest in the country. It directly impacts financial planning, compliance requirements, and overall business strategy. Staying informed about recent changes and implications for foreign investors is key to making sound financial decisions. Additionally, having a solid understanding of China tax rates can provide businesses with a competitive advantage in the market, as they can make more accurate projections and budgeting decisions.

AC&E: Your Expert Guide to China Taxation

AC&E offers unparalleled expertise in navigating the complexities of China taxation. With a deep understanding of local laws and regulations, as well as extensive experience working with foreign investors, AC&E is uniquely positioned to provide valuable guidance on managing tax obligations in China.

AC&E's team of tax experts stays up-to-date on the latest changes to China's tax laws, ensuring that clients receive accurate and timely advice. With a focus on proactive tax planning, AC&E helps businesses minimize their tax liabilities while remaining compliant with local regulations. Whether it's navigating transfer pricing rules or understanding VAT requirements, AC&E is committed to helping clients achieve their financial goals in China.

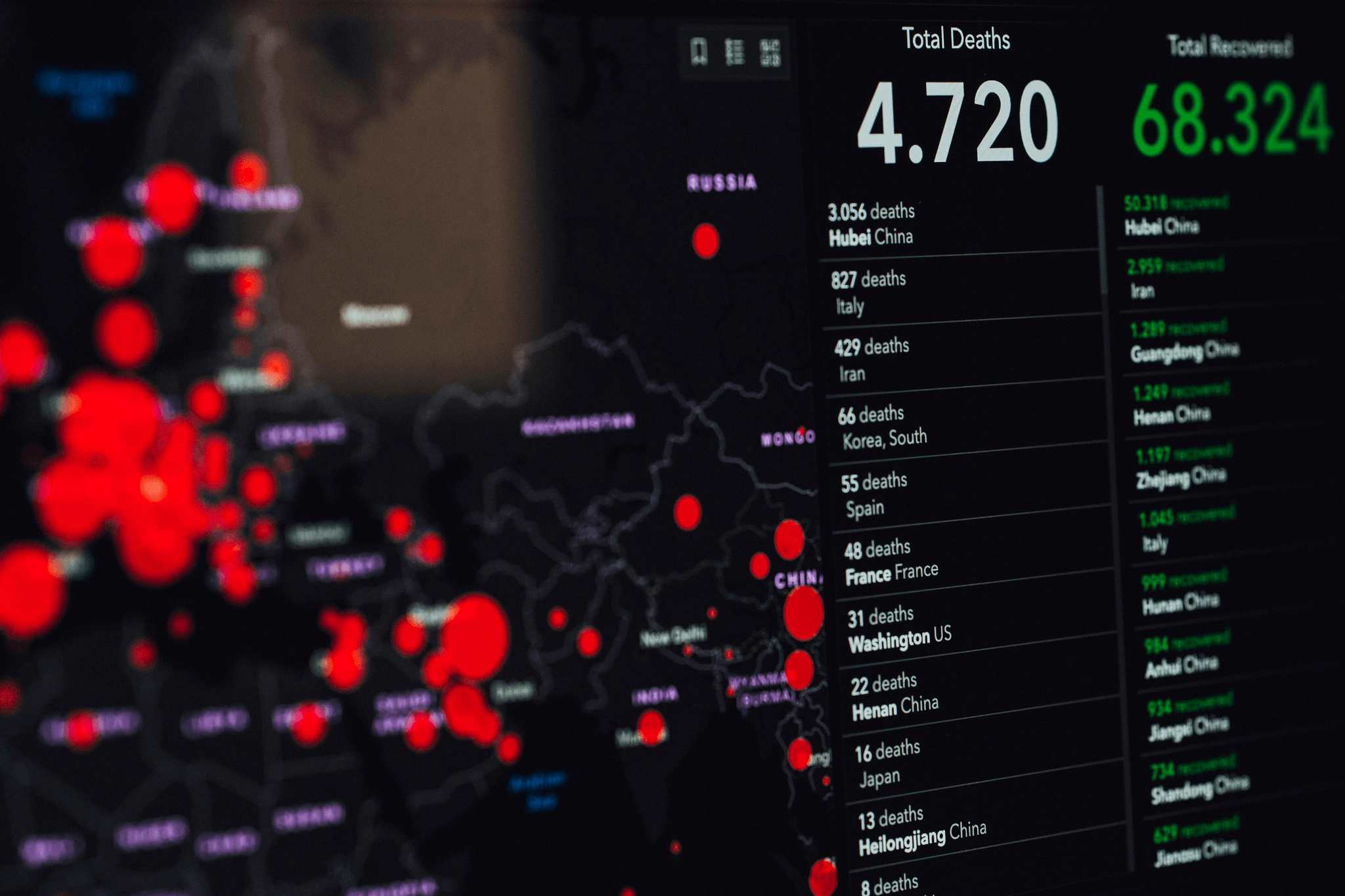

New Changes in China Taxation Rates

As China continues to evolve, so do its taxation rates. Recent adjustments to corporate tax rates have sparked interest and concern among foreign investors and local businesses alike. With the implementation of new tax policies, it's crucial to understand the implications and potential impact on financial planning.

Recent Adjustments to Corporate Tax Rates

In response to economic shifts, China has made significant changes to its corporate tax rates. Understanding these adjustments is essential for businesses operating in the region, as they directly affect profit margins and financial projections. As a result, many companies are reevaluating their investment strategies and considering potential restructuring to optimize tax benefits.

As a result of these changes, foreign investors are closely monitoring the situation to assess the potential impact on their operations in China. The adjustments in corporate tax rates could influence the overall attractiveness of the region for foreign investment, prompting companies to reconsider their expansion plans or evaluate alternative markets. This uncertainty may lead to a period of cautious observation as investors await further clarity on the implications of the new tax regulations.

Implications for Foreign Investors

Foreign investors play a pivotal role in China's economy, making it imperative for them to comprehend the implications of new tax regulations. These adjustments can influence investment decisions, capital allocation, and overall profitability. As such, staying informed about the latest developments in China's taxation system is vital for maintaining a competitive edge in the market.

Furthermore, understanding the tax implications in China can also help foreign investors navigate the complexities of compliance and reporting requirements. By staying abreast of the latest developments, investors can ensure that they are fulfilling their tax obligations accurately and in a timely manner, avoiding potential penalties or legal issues. This level of compliance not only fosters a positive reputation but also builds trust with local authorities and business partners, ultimately contributing to long-term success in the Chinese market.

Exploring the Impact on Local Businesses

Local businesses are also feeling the effects of recent changes in China's taxation rates. From small enterprises to large corporations, understanding how these adjustments impact their bottom line is crucial for sustainable growth and financial stability. By proactively adapting to new tax policies, businesses can mitigate potential risks and capitalize on emerging opportunities.

Remember that staying ahead of these changes requires proactive engagement with legal experts who specialize in navigating China's complex taxation landscape. AC&E offers comprehensive support tailored specifically for foreign investors and local businesses operating within China’s jurisdiction.

Understanding China Taxation System

Breakdown of Different Types of Taxes

China taxation rates encompass a variety of taxes, including value-added tax (VAT), corporate income tax, individual income tax, and customs duties. VAT is the most significant tax in China, accounting for over 30% of total tax revenue. Corporate income tax is levied on both domestic and foreign companies operating in China, while individual income tax is based on a progressive tax rate system.

How China Taxes its Citizens

China taxes its citizens through individual income tax, which is calculated based on a progressive tax rate ranging from 3% to 45%. Residents are taxed on their worldwide income, while non-residents are only taxed on their China-sourced income. The government also imposes social security contributions to fund healthcare, pensions, and other social welfare programs.

Key Factors Affecting China Tax Revenue

Several key factors affect China's tax revenue, including economic growth, changes in the business environment, and government policies. Economic growth directly impacts corporate profits and individual incomes, thereby influencing tax revenue. Changes in the business environment can lead to shifts in corporate investment and consumption patterns that impact taxation rates.

Navigating China Tax Rate for Foreigners

Navigating the complex world of China taxation as a foreigner can be daunting, but AC&E is here to provide expert advice on tax obligations for foreigners. Our team of legal professionals can guide you through the intricacies of China tax laws, ensuring that you are fully compliant and maximizing your tax benefits.

AC&E's Expert Advice on Tax Obligations for Foreigners

When it comes to understanding your tax obligations as a foreigner in China, AC&E has the expertise to provide tailored guidance. Whether you're an expatriate working in China or a foreign investor, our team can help you navigate the nuances of the China taxation system and ensure that you meet all necessary requirements while optimizing your tax position.

Using China Tax Rate Calculator for Foreign Investors

AC&E offers a user-friendly China tax rate calculator designed specifically for foreign investors. This tool allows you to input relevant financial data and receive an accurate assessment of your potential tax liabilities in China. With this resource at your disposal, you can make informed decisions about your investments and financial planning strategies.

Strategies for Managing Effective Tax Rate in China

Managing an effective tax rate in China requires careful planning and strategic decision-making. AC&E can assist you in developing personalized strategies to minimize your tax burden while remaining compliant with local regulations. From structuring investments to utilizing available deductions, our team can help you optimize your effective tax rate in China.

With AC&E's expert advice, tailored tax rate calculator, and personalized strategies, navigating the complexities of China taxation as a foreigner has never been easier or more beneficial for your financial well-being.

Compliance and Reporting Requirements

When it comes to ensuring compliance with China tax laws, it's crucial for businesses to stay updated on the latest regulations and requirements. AC&E provides expert guidance on navigating the complex landscape of China taxation, helping companies avoid potential penalties and legal issues.

Ensuring Compliance with China Tax Laws

AC&E's team of legal professionals is well-versed in China's ever-evolving tax laws, offering comprehensive support to ensure that businesses remain fully compliant. By staying informed about changes in regulations and filing requirements, companies can mitigate risks and maintain a positive standing with Chinese authorities.

Best Practices for Reporting Corporate Taxes

Reporting corporate taxes in China requires accuracy and attention to detail. AC&E assists clients in adopting best practices for tax reporting, helping them streamline the process while adhering to all necessary guidelines. From proper documentation to timely submissions, our experts guide businesses through every step of the reporting process.

AC&E's Role in Assisting with Tax Compliance

As a trusted partner for legal solutions in China, AC&E plays a vital role in assisting businesses with tax compliance. Our team offers personalized support tailored to each client's unique needs, ensuring that they have the knowledge and resources required to meet their tax obligations effectively.

With AC&E by your side, navigating compliance and reporting requirements becomes a manageable task rather than an overwhelming burden. Our expertise helps businesses maintain a strong foothold in the competitive Chinese market while upholding their financial responsibilities.

Future Outlook for China Taxation

As China continues to evolve its tax policies, businesses must stay informed about anticipated changes in tax laws. AC&E's team of experts closely monitors these developments to provide proactive guidance and support.

Anticipated Changes in Tax Policies

With the upcoming changes in tax policies, businesses operating in China need to be prepared for potential adjustments to corporate tax rates and other tax regulations. AC&E's legal team is well-equipped to help clients navigate these changes and ensure compliance with new tax laws.

Potential Impact on Corporate Financial Planning

The potential impact of future changes in China's taxation rates on corporate financial planning cannot be underestimated. It is crucial for companies to anticipate and adapt to these changes, and AC&E can offer valuable insights and strategies for effective financial planning amidst evolving tax policies.

AC&E's Proactive Approach to Navigating Future Taxation Updates

AC&E takes a proactive approach to navigating future taxation updates by staying ahead of the curve and providing clients with comprehensive legal solutions tailored to their specific needs. With our expertise, businesses can confidently navigate future taxation updates with minimal disruption.

Partnering with AC&E ensures that your business stays ahead of the curve when it comes to understanding and adapting to China's ever-changing taxation landscape. Our proactive approach allows us to provide expert guidance on anticipated changes in tax policies and their potential impact on corporate financial planning, enabling you to make informed decisions that align with your business goals.

Conclusion

When it comes to corporate tax planning in China, it's crucial to consider the ever-changing landscape of China taxation rates. Understanding the implications of recent adjustments and anticipating future changes is key for effective financial planning.

Key Considerations for Corporate Tax Planning in China

As a foreign investor or local business, staying informed about new changes in China tax rates is essential for strategic decision-making. With AC&E's expert guidance, navigating the complexities of the China taxation system becomes more manageable, allowing for proactive tax planning and compliance.

Partnering with AC&E for Expert Legal Guidance

AC&E offers specialized expertise in China tax rate corporate matters, providing tailored advice to foreign investors on their tax obligations and strategies for managing effective tax rates in China. By partnering with AC&E, businesses can ensure they are fully compliant with China tax laws while optimizing their financial position.

Taking Advantage of AC&E's Comprehensive Legal Solutions

From utilizing the China tax rate calculator for foreigners to ensuring compliance and reporting requirements are met, AC&E provides comprehensive legal solutions that address all aspects of taxation in China. By leveraging our expertise, businesses can navigate the complexities of the China taxation system with confidence.

With a keen understanding of the nuances of china taxation rates, AC&E is your trusted partner for expert legal guidance on all matters related to taxation in China. Whether it's corporate tax planning or compliance requirements, our comprehensive solutions ensure that businesses can navigate the intricate landscape of Chinese taxation with ease.